Providence Chain Goes Public

Industry publication McKnights reported that Providence Group chain is going public. Providence Administrative Consulting Services or PACS Group, a Utah-based nursing home operator that has quickly become one of the nation’s largest, filed paperwork to become a public company.

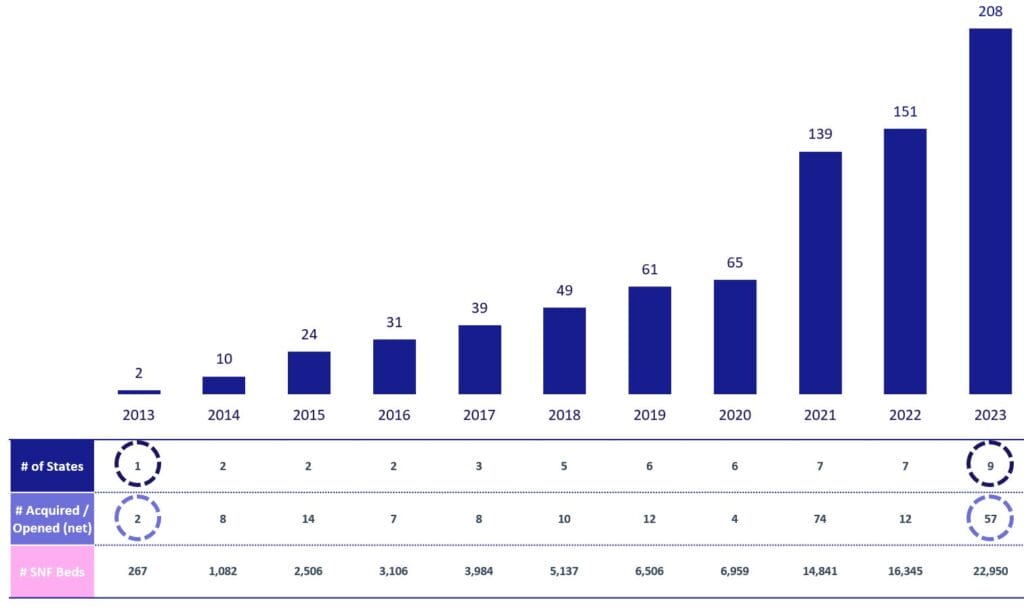

Founded in 2013, PACS now manages more than 200 post-acute facilities, most of them nursing homes, in nine states. In conjunction with its Providence Group team, PACS serves more than 20,000 patients daily, and the company had a total revenue of $3.1 billion in 2023, according to its filings with the US Securities and Exchange Commission.

PACS would join Ensign as one of the largest being publicly traded. PACS plans to list on the NYSE under the symbol PACS.

In January, the company announced the appointment of three new executive leaders, a move often seen in the lead-up to an initial listing. PACS expects to raise up to $100 million with potential value of up to $500 million. Among the underwriters for the IPO are Truist Securities, Citibank, JP Morgan Chase and Regions Capital Markets. PACS acknowledged it leases most of its buildings to real estate investment trusts, including CareTrust.

This graphic from PACS Group’s IPO paperwork highlights the company’s quick rise to prominence in the US nursing home market. Source: PACS Group S-1 Registration Statement.

Recent Comments