Home as the Default

Occupancy Declines

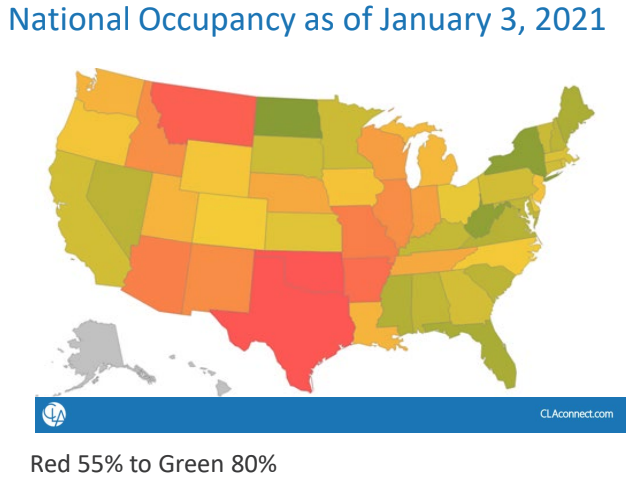

Fox Business reported that families continue to choose home health and other options to avoid nursing homes. COVID-19 has reshaped the future of the nursing home industry. Americans rely on institutions to care for vulnerable seniors. Nursing-home use in the U.S. has been declining gradually for years. In 2019, occupancy was 80%, down from 84% a decade earlier, according to the Kaiser Family Foundation.

The U.S. still has the largest number of citizens in nursing homes. However, occupancy is down by 15%, or more than 195,000 residents, since the end of 2019.

A Wall Street Journal analysis of federal data shows COVID deaths to be the main cause. Surveys have long shown many patients don’t want to go to nursing homes.

Hospital referrals to the skilled nursing setting plummeted over the course of the pandemic, a study from Avalere Health found.

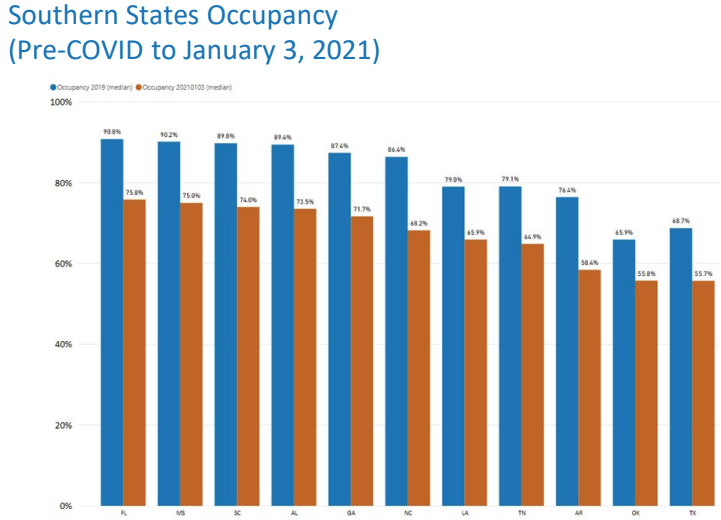

The states covered in the chart, from left to right, are Florida, Mississippi, South Carolina, Alabama, Georgia, North Carolina, Louisiana, Tennessee, Arkansas, Oklahoma, and Texas.

Alternative Options

Many predict fundamental changes to referral and care services established during the crisis will remain. Technology allows many patients with significant care needs to be home. South Carolina’s Prisma Health offers support to sicker patients recovering at home. They often use technology to allow close monitoring. For example, Home Recovery Care is a joint venture with a company called Contessa Health Inc. that provides operational support and technology services. Prisma Health officials said some hospital patients who might qualify for a nursing-home stay are instead sent home using the new program.

Medicare allows reimbursement to pay for digital doctor visits and hospital-level care in patients’ homes. The large for-profit chains are including home-focused offerings, additional services like dialysis, and increasing staff for hospital-level care.

“Do I think that more patients will be moved to home? Absolutely. It’s the right thing to do for the patient, it’s the right thing to do for the system, and it’s the right thing to do for the cost,” said David Parker, president of ProMedica Senior Care, a major nursing-home operator that also owns a home-health-care provider and is part of ProMedica Health System.

For years, a few government policies have offered alternatives to nursing homes. Medicaid programs have increasingly paid for long-term services that help patients remain at home such as health-care aides. Funding is far short of demand. Medicare has begun paying health-care providers that bring down costs.

“We should be able to provide more services in the home setting that can enable somebody to be independent,” said Seema Verma, administrator of CMS. “Covid is going to force a national conversation about how we take care of our elderly, and clearly there are issues in nursing homes that go beyond infection control,” she said.

Nursing homes’ loss has been a gain for home-health companies. They provide services such as therapy and nursing visits, though typically not 24-hour care. Perfect for many families, and much cheaper than institutional care. Shares of Amedisys Inc., the largest publicly traded home-health-care company, are up nearly 75% in 2020. It saw strong volumes and higher profits in the third quarter.

Recent Comments