Where does all the money go?

A recent study titled “Tunneling and Hidden Profits in Health Care” proves the lack of transparency in the nursing home industry where hundreds of billions of taxpayer dollars are siphoned to real estate investors, private equity, and greedy owners. The industry complains that they are too poor to pay workers a fair wage. Where does all the money go?

In his recent article for Forbes, Howard Gleckman, a senior fellow at The Urban Institute, analyzes a new study on the old practice of money being diverted to operator-owned ancillary businesses for the purpose of hiding profits with related entities. Related party transactions involve overstating costs and understating profits reported to the government, primarily through real estate and management services.

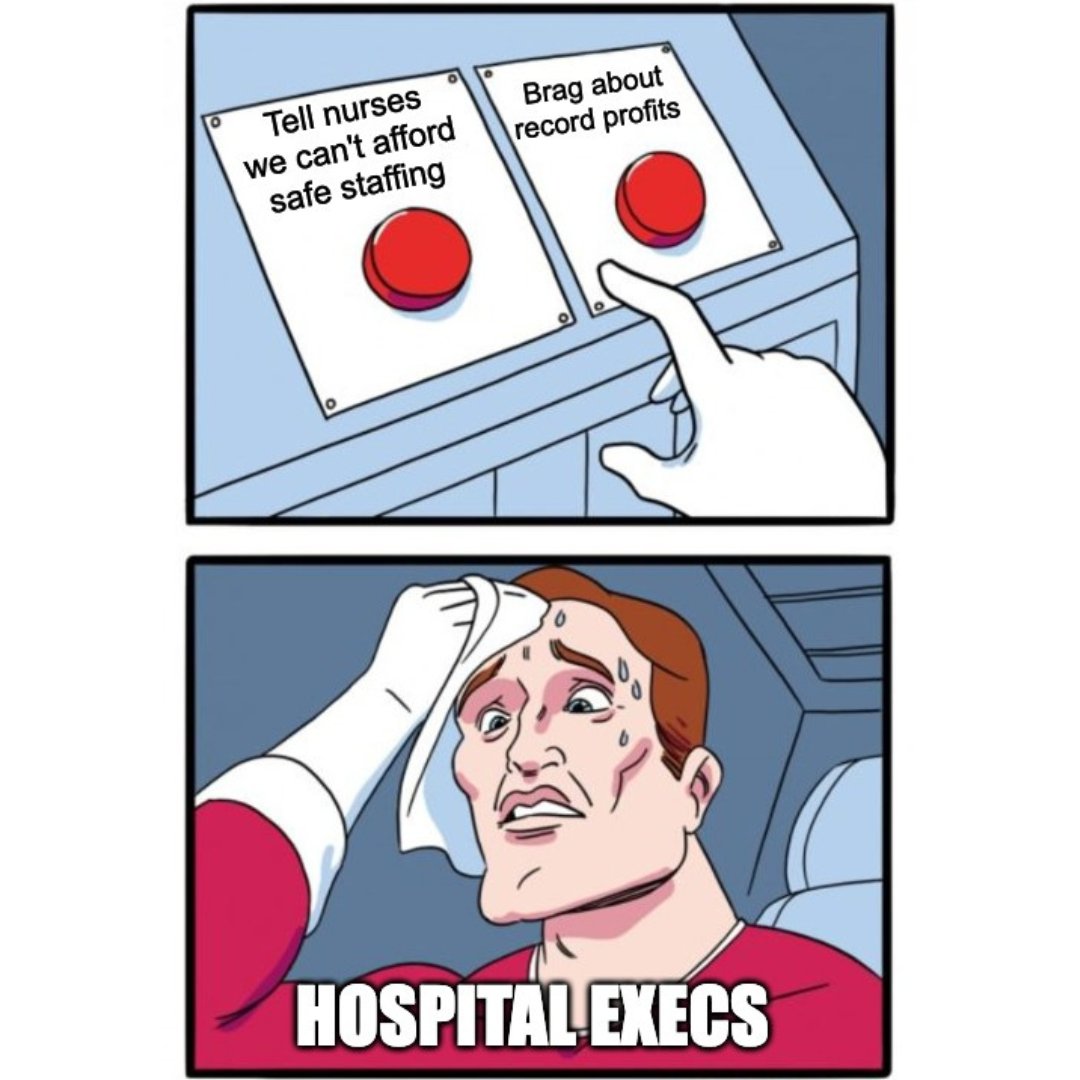

Now, Congressional leaders demand answers on spending of three large chains that provide long-term care: Ensign Group, National HealthCare Corp. and Brookdale Senior Living. The Congressional letters suggest that nursing homes’ workforce shortages and high turnover rates may be due to bad business practices. The three providers siphoned a combined $420 million on stock buybacks and $220 million on executive pay between 2018 and 2023, the letters state. The lawmakers said such spending undermines “the claim that nursing homes cannot afford to pay for enough staff” to meet the new rule.

They also highlighted reporting that providers hide profits through related-party transactions in a process known as tunneling.

“Turnover is high due to poor working conditions, understaffing of facilities, and low pay – conditions that you are in position to rectify,” the lawmakers wrote to the providers. “CMS’ new rule to set a minimum staffing standard would make these jobs more attractive to workers.”

Staff turnover is over 60%, pay is exceedingly low, staff are undervalued, and, they are scapegoated for harms caused by owners’ prioritizing profits over care. This for-profit industry is made up of investors and equity interests, including “related parties” who siphon off cash to make it appear as if the nursing home is losing money.

Residents deserve more care and far better care than they are provided. It is long overdue to prioritize the most basic, the most impactful changes that are known and understood by everyone to protect and enhance residents’ lives: staffing. Notably, more than two decades ago, a study commissioned by CMS found that 4.1 hours of care per resident day was necessary to support quality care and avoid harm, including 0.75 RN hours, 0.55 LPN/LVN hours, and 2.8 CNA hours. Of course, every resident will tell you that staffing levels are grossly inadequate.

Ensign is among the nation’s largest skilled nursing providers, with 310 healthcare operations, the vast majority of them nursing homes, across 14 states.

Ensign’s liquidity remains strong with $511.8 million of cash on hand and $593.7 million of available capacity under its line-of-credit. Combined with cash on hand on the company’s balance sheet, the firm has $1 billion dollars in dry powder for future investment.

Ensign Group CEO Barry Port told investors during a first-quarter earnings call:

After another record quarter, we are excited about the remarkable momentum our teams have created across our entire portfolio and look forward to seeing that continue throughout the year. As strong as our performance has been, we continue to see enormous opportunities inherent in our portfolio, both in existing operations and the growing number of new acquisitions.

The Ensign Group announced a sweeping package of deals. Chad Keetch, Ensign’s chief investment officer noted that Ensign had added 13 new operations and six real estate properties. He said that action brings the number of operations acquired by Ensign since January 2023 to 39.